Anaerobic Digester Loans

Flexible Lending Options

for Anaerobic Digesters

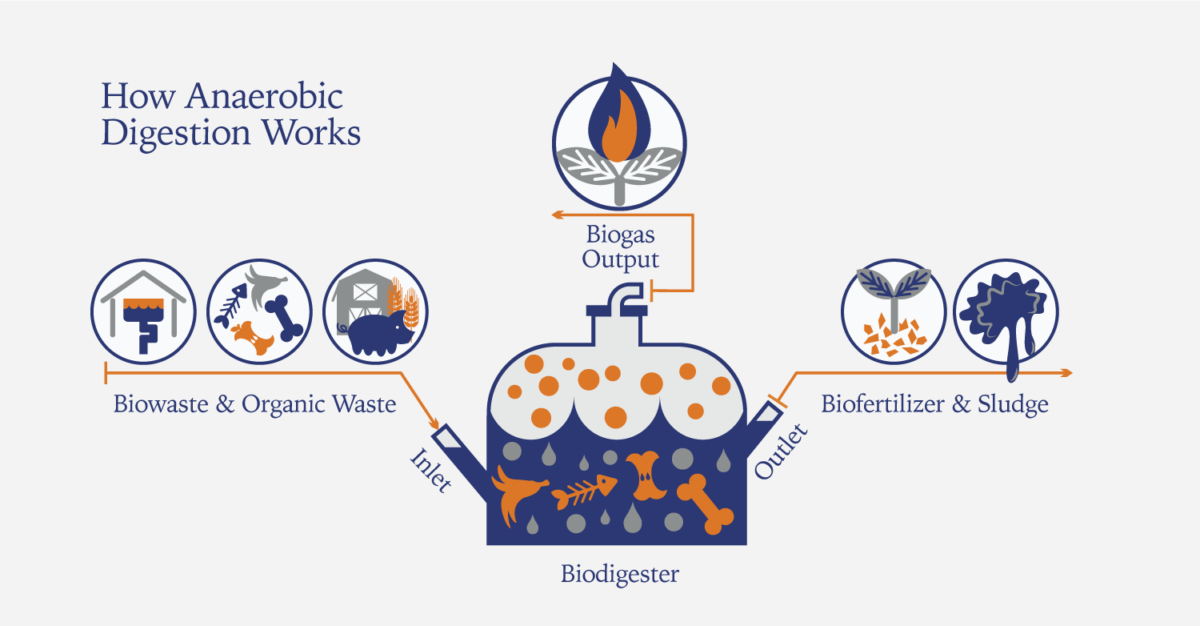

Some forms of renewable energy are straight forward. The sun emits heat; the wind, force. But others produce power in non-obvious ways. Consider sewage. Animal manure, sewage sludge, and food scraps are more powerful than one might think. When such discarded materials degrade, they put off gases that can be captured and used as fuel. This process, known as anaerobic digestion, can be captured in a facility called an anaerobic digester.

Inside its oxygen-free environment, biogas is created as materials break down, leaving methane (CH4) and carbon dioxide (CO2) in their wake. After carbon dioxide is removed, methane—the main ingredient in natural gas—remains. Its impact? Sustainable food production, farm-community relationships, rural economic growth, new jobs, diversied farm revenue, and energy independence. Translation: nothing wasted.

LOAN DETAILS

- Finance up to 80% of Eligible Project Costs

- $2 Million - $25 Million Loan Amounts

- USDA REAP Loans

USDA Rural Energy for America Program Loans

Renewable Energy Systems

Biomass

Geothermal

Hydropower

Hydrogen

Wind Generation

Solar Generation

Ocean Generation

Energy Efficient Improvements

HVAC

Insulation

Lighting

Cooling & Refrigeration

Doors & Windows

Pumps for Sprinkler Pivots

Diesel to Electric Irrigation Motor

Turning Waste into Resources

According to historians, the potential of anaerobic digestion was discovered in the 17th century when Jan Baptita van Helmont noticed that decaying organic matter could produce ammable gasses. Anaerobic digestion facilities, on the other hand, are a more recent invention. Most common to livestock farms, some European facilities have been in operation for 20 or so years, while American facilities are just gaining ground. Many farmers are discovering the value of adding an anaerobic digester to current standing farms/cattle yards in order to diversify farm revenue.

If an anaerobic digester is installed in a rural location, it can benefit from special financing from the USDA. The government agency more commonly known for its service to agriculture also backs a government-guaranteed lending program specifically for rural energy projects – no agricultural component required. The USDA-backed loans range from $2 million to $25 million.

Not searching for anaerobic digesters? You have options.

The USDA’s Rural Energy for America Program (REAP) provides government-guaranteed loans and grants to agricultural producers and rural small businesses to upgrade, replace, or construct energy-efficient systems. Qualifying systems include renewable energy systems such as biomass, geothermal, hydropower, hydrogen, wind generation, ocean generation, and solar, as well as energy-efficient improvements like HVAC, insulation, lighting, cooling, refrigeration, doors, windows, and more. As with the USDA’s other specialty lending programs, partnering with a rural lending expert like NAC offers borrowers a significant advantage as they navigate the unfamiliar application process.

FAQs

Anaerobic digester financing from NAC harnesses a government-guaranteed lending program called USDA Rural Energy for America Program (REAP). The competitive financing offers funding for projects that traditional banks often decline

Agricultural producers or rural small businesses with no outstanding delinquent federal taxes, debt, judgement, or debarment.

USDA REAP loans can be used to purchase renewable energy systems like building an anaerobic digester or making energy-efficiency improvements.

Why Choose North Avenue Capital?

Availability of Capital

As a rural business, you could qualify for up to $25 million in funding per project – substantially more than is available through traditional lenders.

Interest-Only Options

Startup-Friendly

NAC partners with businesses of all varieties, including well-established corporations, startup enterprises, and everything in between.

Simplified Structure

NAC can consolidate multiple types of debt into a single, amortized, non-callable, balloon-payment-free loan structure.